Client Forms

- All

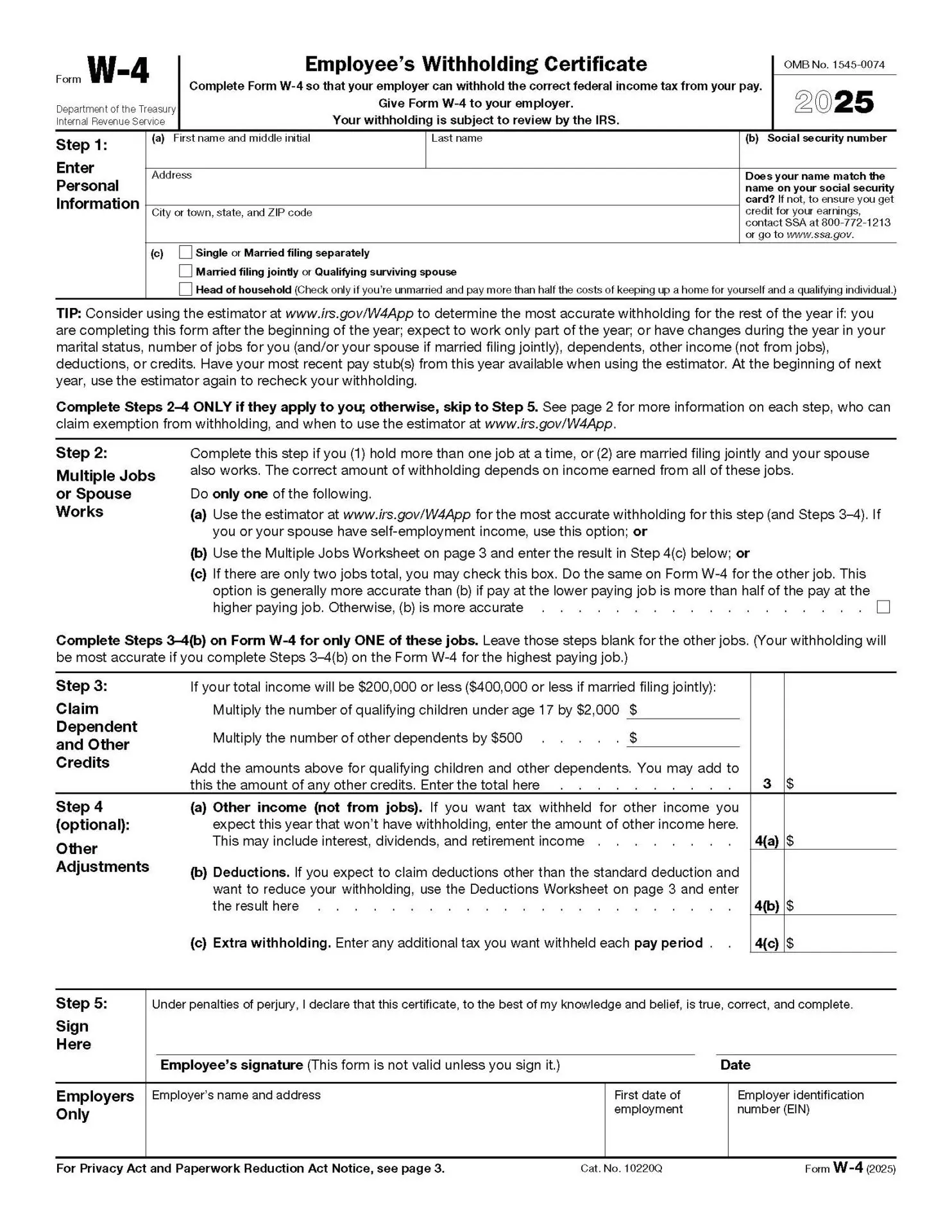

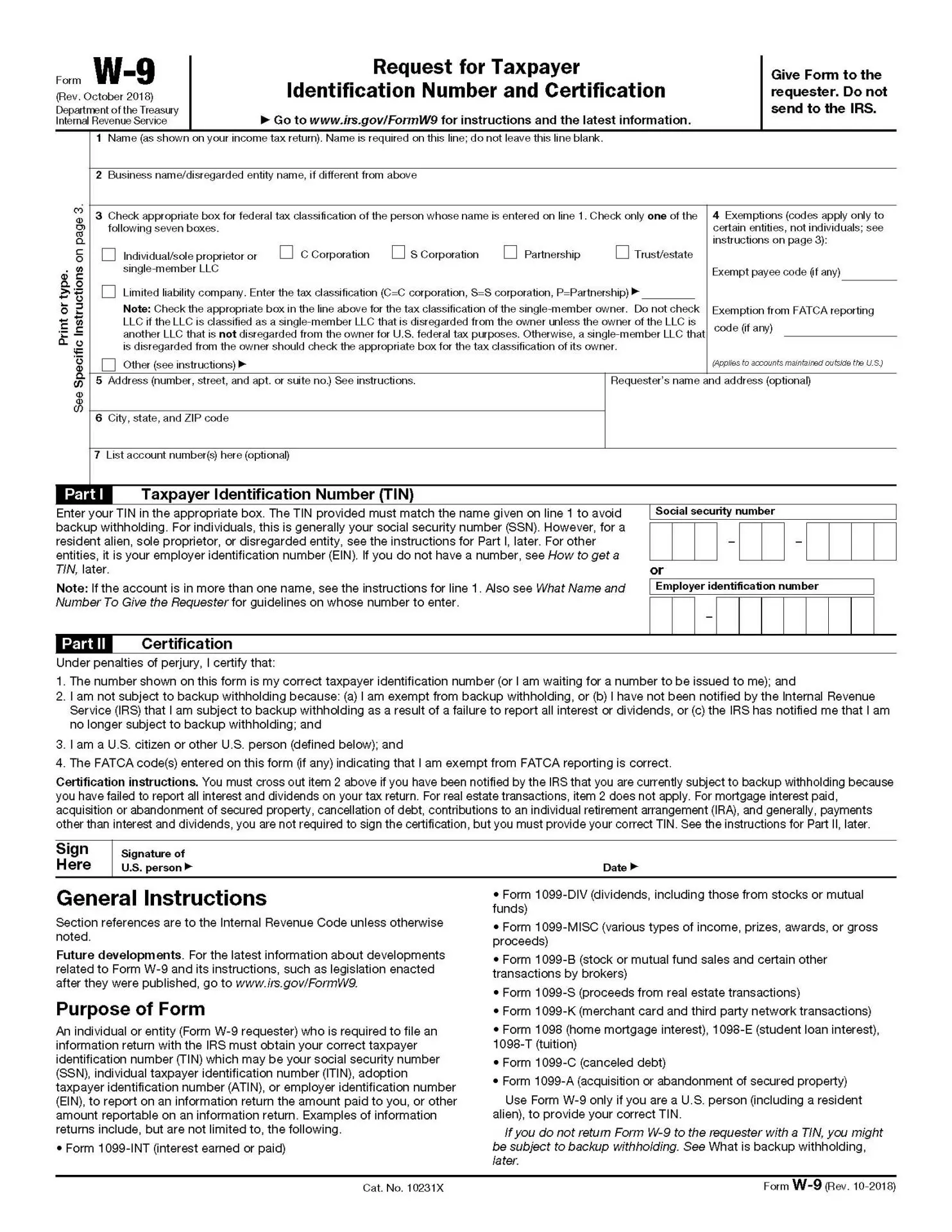

- Employee + New Hire Forms

- BANK CHANGE FORM

- Additional User REQUEST

Guides

Search our library of guides by entering a topic or filtering by module (in blue). If you can’t find what you need, check out our tutorial videos or book a one-on-one training with a member of our awesome support team.

- All Solution Guides

- Payroll Solution Guides

- Time + Attendance Guides

- Expense Management Guides

- HR Solution Guides

- Onboarding Guides

- Benefits Guides

Payroll Processing Instructions

Reports Only Viewing Instructions

ESS for Clients (Employee Self-Service)

ESS for Employees (Employee Self Service)

How to Set Up a User Login

Workers Comp Audit Reports

Updating Employee Tax Information

Employee Salary

Additional or Manual Check Instructions

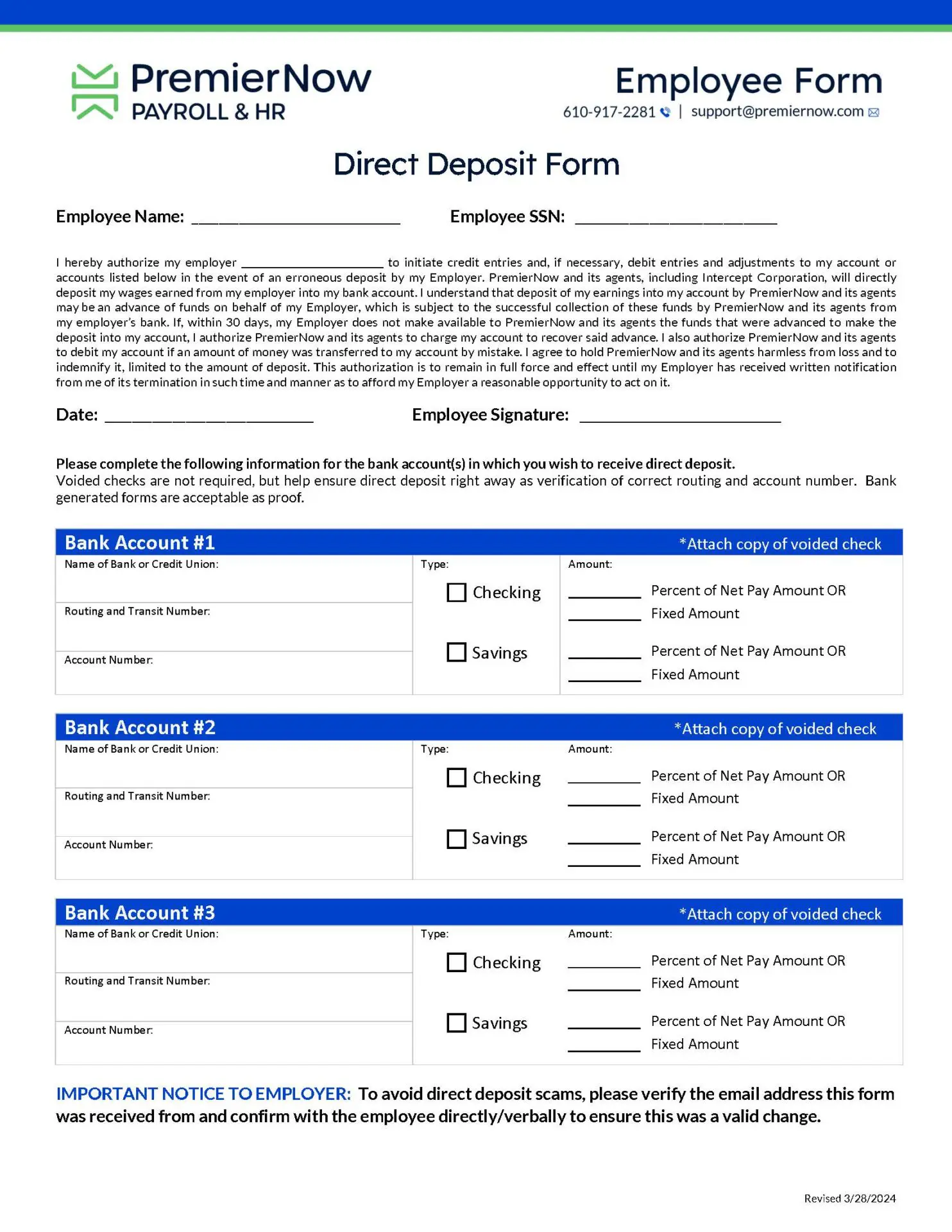

Employee Direct Deposit

How to Create an Import Spreadsheet

How to Enter Employee Retirement Deductions

Frequently Asked Questions

Need-to-Know Info for New Clients

On your isolved landing page (the first page you see when you log in), you can find important links and announcements that will save you time!

At the bottom, see the NEXT SCHEDULED PAYROLL section.

This section displays your next pay period and check date. You can also view/print your entire Processing Schedule including pay period and check date for the whole year.

Payroll Submission Deadlines

While payrolls can be submitted 24/7, there are deadlines that apply to Direct Deposit and Delivery:

Direct Deposit

Payrolls must be submitted by 2pm** TWO business days prior to check date (ex. Payroll must be submitted by 2pm on Wednesday for a Friday check date. Payrolls can be submitted on Monday or Tuesday for a Friday check date and will NOT have the funds pulled any earlier). If there is a bank holiday, then payroll must be submitted a day earlier than normal (ex. if bank holiday is on a Wednesday, Thursday or Friday, then payroll must be submitted by Tuesday for a Thursday or Friday check date). The support team will be sending out email reminders as well.

The landing page also helps give a heads up of due dates:

Courier/Mail Delivery

Courier/Mail Delivery Payrolls must be submitted by 2pm** on the day you want it to be sent with the Courier/Mail for delivery the next day

Pickup

For pickup, please allow 2 hours for processing/packaging.

**Fridays – payrolls must be submitted by 11am on Fridays since we close early; payrolls submitted after 11am will be processed on Mondays

Account Funding Deadlines

If you have Direct Deposit, your account must be funded TWO business days prior to check date (ex. your account must be funded Wednesday afternoon for a Friday check date – the bank will pull from your account Wednesday night and deposit in your employees’ accounts on Friday). NSF fee is $75; our bank has a 3-strike rule – DD is stopped after 3 NSFs. Do NOT submit your payroll if you do not have the funds as late payment of taxes will lead to expensive penalties and fines. If you have any live checks in your payroll, they will clear your account once the employee deposits or cashes them at their personal bank.

Top 5 isolved FAQs for New Clients

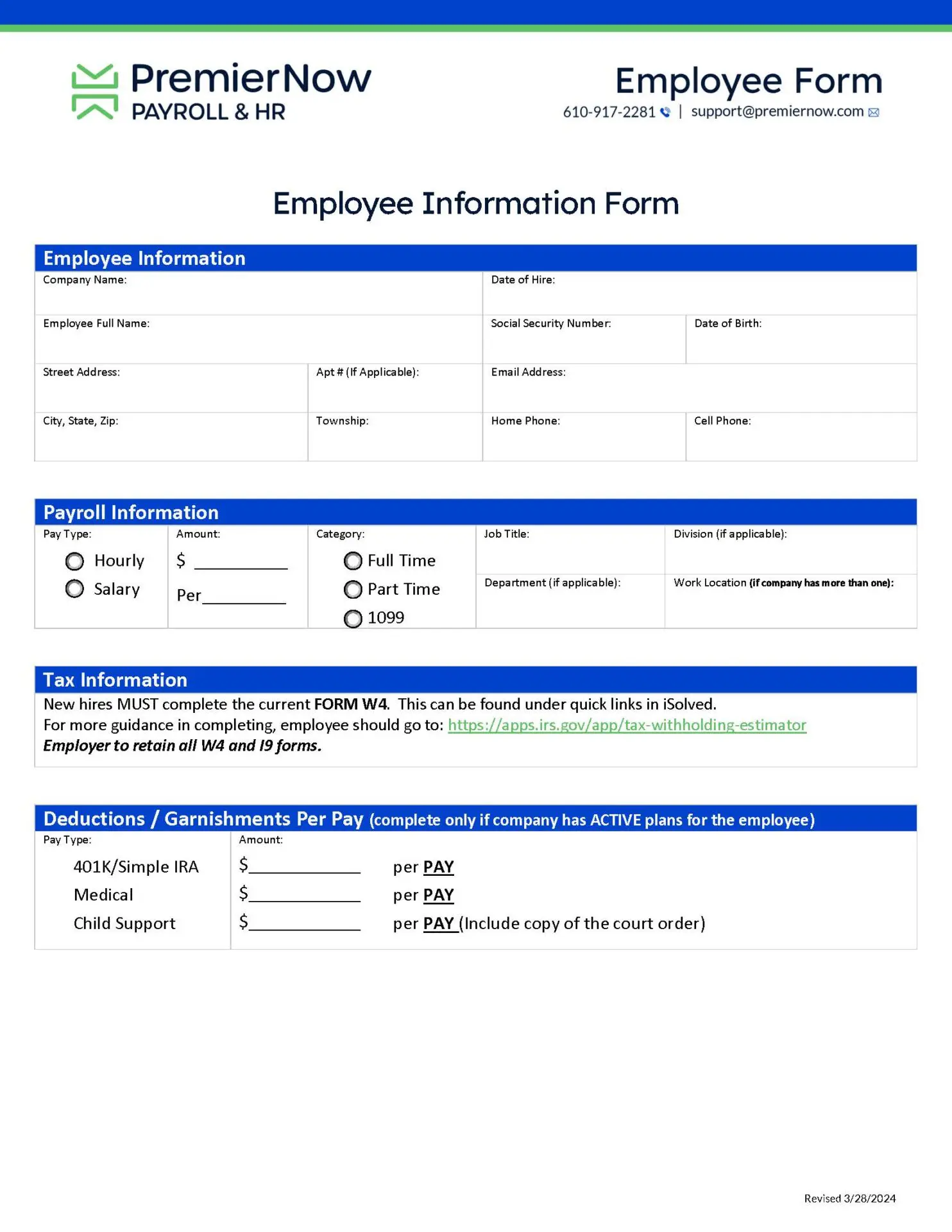

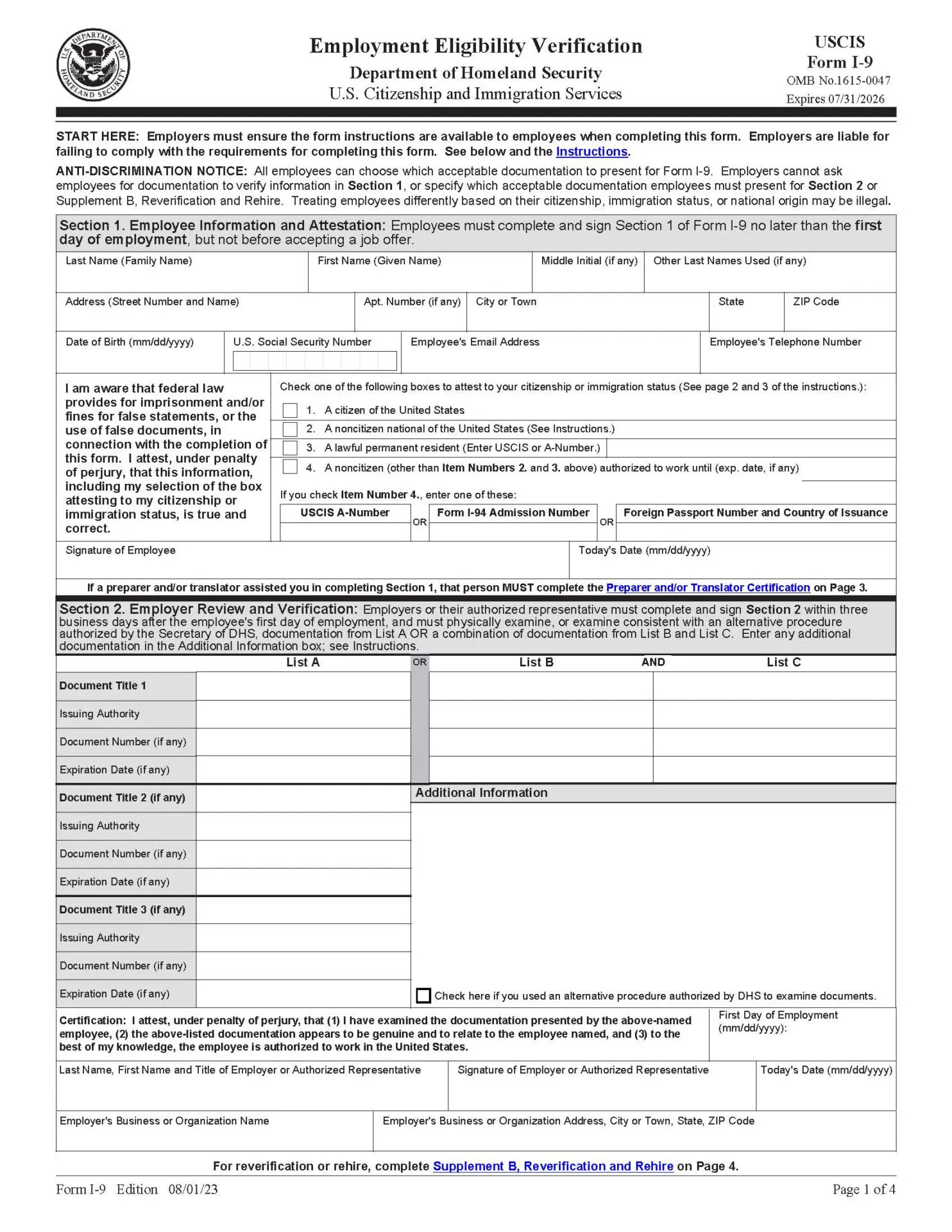

Watch our tutorial video on entering a new hire, or read the guide here.

Before you submit each payroll, you should review:

- PAYROLL SUMMARY report ¬– to see total cash needed to cover payroll

- PAYROLL REGISTER report – to review the employee detail of hours being paid

- NEW EMPLOYEE & CHANGE AUDIT report – allows you to verify all Direct Deposit changes

- EXCEPTIONS – catch any mistakes BEFORE processing! After your payroll is processed:

- EXCEL – most reports can be exported in EXCEL format!

- CUSTOM REPORTS – we can always create/add reports specific to your company’s needs. Please contact [email protected] if you need a customized report.

Page 3 of the PAYROLL SUMMARY REPORT details the taxes that you as the employer pay in addition to the wages of employees.

Prenote (we recommend) verifies the bank account information is accurate and the bank will accept direct deposit. The employee will receive a live check while the account is prenoted. The system will automatically update to ACTIVE once approved (usually 10 business days).

Active will have the employee receive direct deposit right away based on the bank account information you enter into the system. There is the risk that incorrect information would prevent direct deposit from occurring; worst case is if a valid routing & account # was entered that was not for that employee, the funds would be deposited into that account as banks do NOT verify the NAME on the account. ALWAYS TRIPLE CHECK YOUR DATA ENTRY (EMPLOYEE NAME, ROUTING & ACCT #) when allowing DD immediately!

It is best practice to terminate an employee in the system. You can always rehire or undo the termination. The employee information does NOT get purged out of the system.

Inactive is mainly for seasonal employees where the employer needs to track who is seasonal (ACA reporting treats Inactive as Active in calculating the FTE so best to Terminate if you are near ACA threshold).

Keeping your employee list accurate will:

- Prevent accidently paying an employee no longer working

- Keep employee reports accurate based on actual active employees (important for ACA reporting)

- Minimize any additional payroll fees

Need to terminate an employee? Watch our tutorial video here.

In order to see information for employees with a terminated or inactive status, navigate to EMPLOYEE MANAGEMENT > EMPLOYEE MAINTENANCE > GENERAL.

- On the employee list, click on the funnel icon next to the STATUS column header.

- Click SELECT ALL, then click OK – this will show you all employees listed in the system, regardless of their status.