Payroll Solutions

Payroll, HR, Time, and Benefits functions are integrated all in one place – ensuring a better experience for you AND your employees – from hire to retire. Clients benefit from seamless and efficient communication that comes with best-in-class customer service that PremierNow is known for.

Get back to running your business.

Your Payroll is Handled.

Let PremierNow take the stress out of payroll. From start to finish, it’s simple, accurate, and hassle-free. Our cloud-based system keeps your data safe and secure, and with full payroll preview, you stay in control. You’ll get heads-up alerts for any issues and have all the reports you need before hitting “submit.”

Employee Self-Service

PremierNow’s Employee Self Service module provides employers and their employees with 24/7 on-line access to personnel information, check stubs, time off accruals and more. Print W2s online and go paperless!

Dashboards, Reports, + Analytics

View your data, your way. Reduce hours spent preparing reports & make the most important reports available for review in minutes.

Consider your Payroll Tax IDs Filed!

PremierNow applies for all payroll-related IDs free of charge - whether you are a start up or existing client who is expanding. No more completing PA-100 or filing out voluntary withholding applications for various states to get payroll IDs.

Stay Compliant

We stay on top of changing legislation so you don’t have to. Remaining in compliance with the ever-changing tangle of regulations is simple with PremierNow.

Payroll Features

Employee self-service

Direct deposit

Quarterly tax returns

Garnishments

Track vacation/sick accruals

General ledger import

Labor distribution

Certified payrolls

Vendor checks

401K plan administration

ACA reporting tools

Custom reporting

Consider payroll taxes handled.

We stay on top of changing tax rules and make sure you stay compliant. We file the appropriate forms and file the taxes for you.

Taxes filed quarterly by PremierNow include 941s, PA- W3, PA-UC2, LST, EIT, & other state/local payroll tax filings

Taxes filed annually by PremierNow include 940s, W2s, W3s, 1099s, 1096s

Payroll tax IDs are filed! PremierNow applies for all payroll-related IDs free of charge.

Expense Management

Streamline the expense reporting process with a system that seamlessly integrates with payroll.

isolved Expense Management helps eliminate the frustrating workload of managing expenses, reimbursing employees, and creating reports. Keep control of expenses and your tax reporting, all from the same fully mobile experience.

Increase Efficiency

- Custom expense fields

- Automated, configurable workflows

- Eliminated paperwork

- Analysis, dashboards, & reports

Reduce Errors & Stay Compliant

- Workflow alerts for missing information

- Alerts for policy violations and compliance law violations

- Enhanced fraud prevention with receipt images and attachments

Better Employee Experience

- Faster reimbursement

- Better employee satisfaction

Reporting

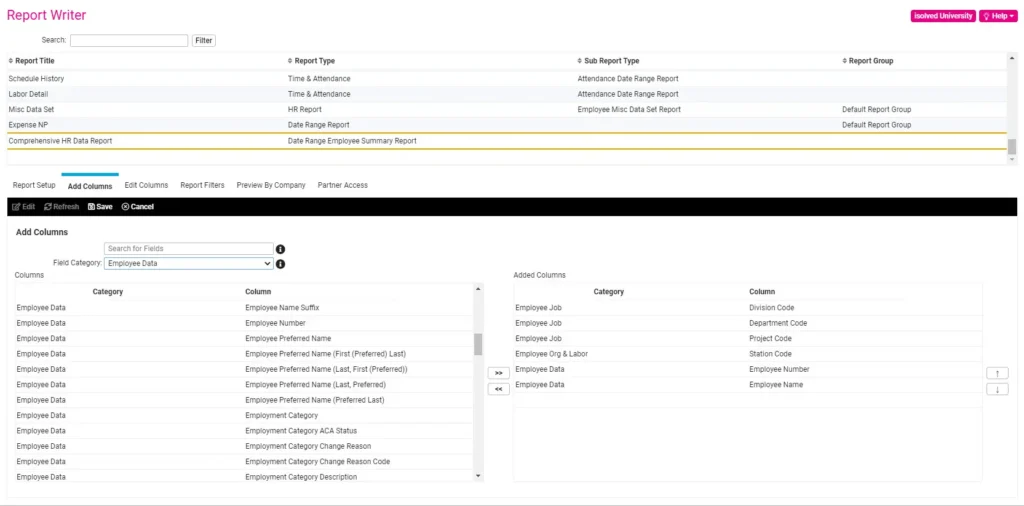

Gain Valuable Insights

Visualize data across with built-in reports for employee payroll summary, payroll check detail, labor distribution, general ledger, education, skills, training, certifications and more.

Customize and Automate Reports

Run reports for date ranges, points in time, single companies, or multiple companies. Enable multiple output views including PDF and Excel while classifying reporting groups to ensure data security and role-based usage.

Earned Wage Access with ZayZoon

With earned wage access, our clients can offer on-demand pay to their employees.

ZayZoon is free for employers and takes only 30 minutes to implement. Employees can use ZayZoon to get paid however and whenever they want. The platform also offers educational resources and tools to help workers break the paycheck-to-paycheck cycle.

Benefits to Employees

- Avoid the need to use high-cost solutions such as payday loans, overdraft fees, title loans, etc.

- Reduces financial stress and improves productivity

- Free perks such as bonus spend at participating retailers/restaurants, CleverRX discount card

- Access to financial wellness tools

Perks for Employers

- No cost to offer earned wage access

- Easy to implement with isolved integration

- Improves employee turnover

- Improves employee satisfaction and productivity

- Does not require Time & Attendance data